-

Our Services

BUSINESS SERVICES

VISA & RESIDENCY

DOCUMENT SERVICES

LEGAL SERVICES

EMIRATES ID

FINANCE SERVICES

-

Courses

-

5-Day Sales Accelerator Bootcamp to Master Goal- Oriented Selling

SALES ACCELERATOR BOOTCAMP

-

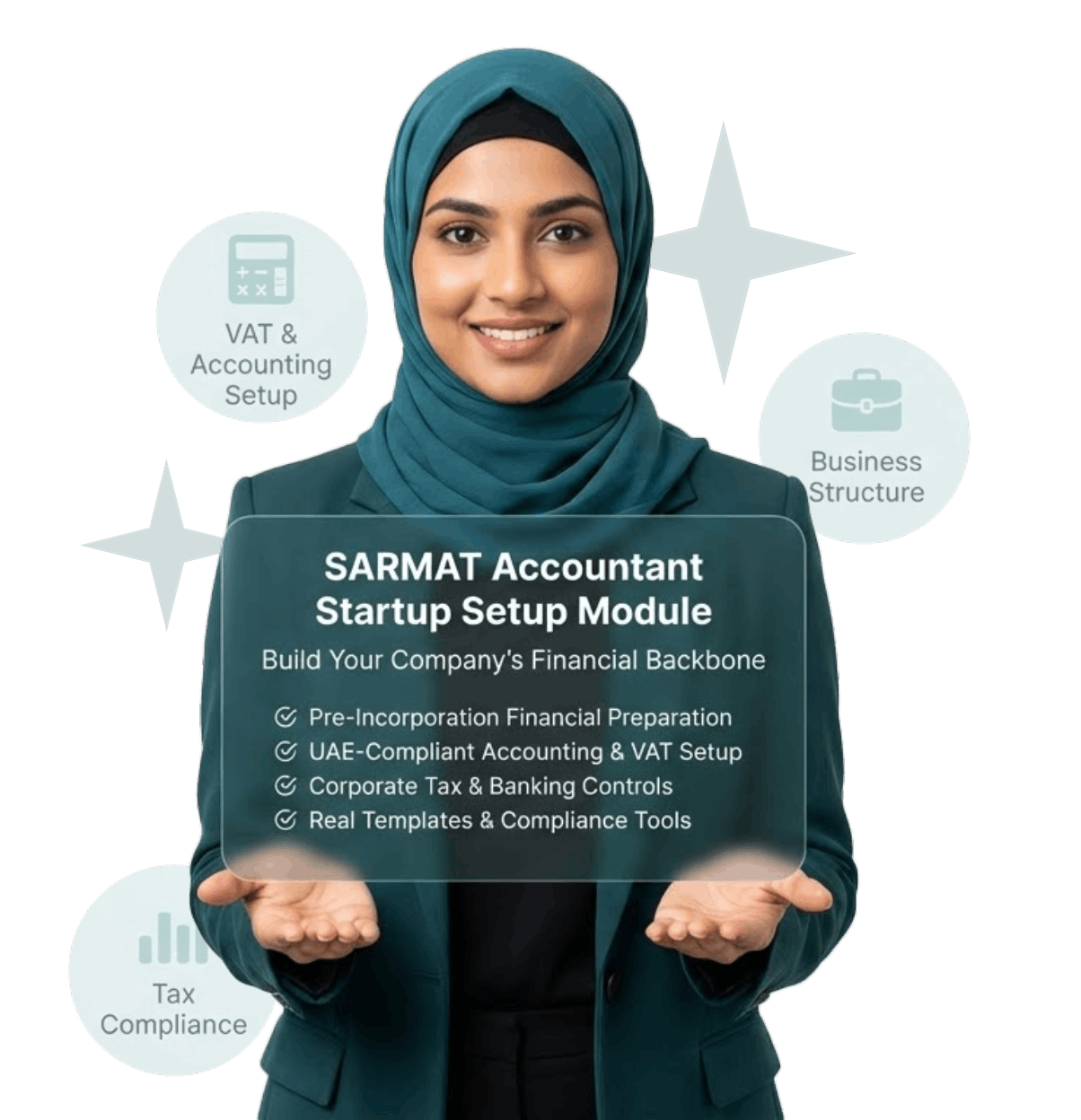

Accountant Startup Setup Module

Build the Financial Foundation Every New Business Needs

- Who We Are

- Resources

BUSINESS SERVICES

VISA & RESIDENCY

DOCUMENT SERVICES

LEGAL SERVICES

EMIRATES ID

FINANCE SERVICES

- Request Services

- KHDA-Certified

- UAE-Specific Curriculum

- 3-Month Mentorship

- Action-Based Curriculum

- Mentorship-Driven

- 15 Hours of Real-Time Workshops

- Certificate of Completion

- Optional KHDA-attested certificate

- A reference copy of UAE Labour Law

- 900+ Hours

- 100+ Mentors

- Zero Tuition

- 5-Day Live Intensive

- Role-Plays & Ready Scripts

- Objection Handling with Confidence

- Company setup procedures

- Accounting systems

- VAT & corporate tax basics

- Internal financial control structures